Venture Capital & Startups in Southeast Asia

Despite the ongoing trade war tensions in Asia, there is large growth potential for startups as venture capital firms eye up the region.

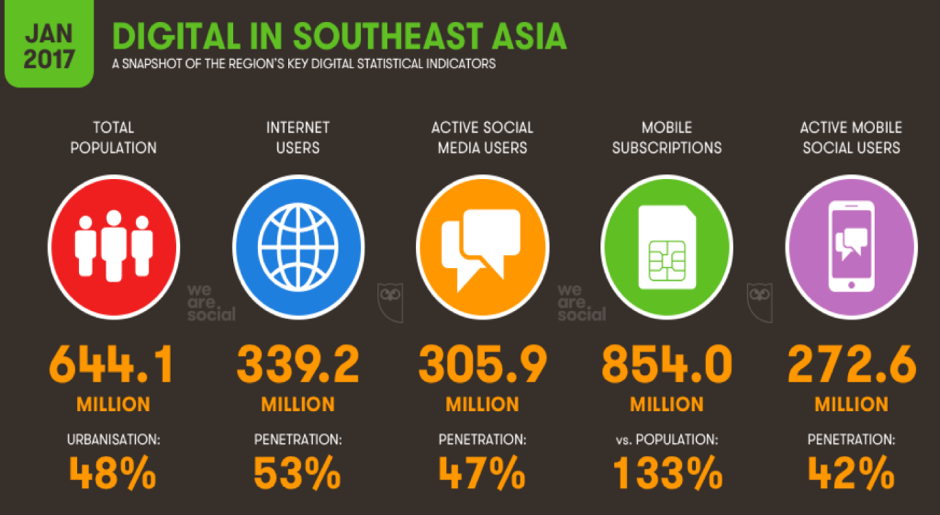

As venture capital ecosystems go, Silicon Valley, Europe and China can be considered mature VC economies. Hence it makes sense for a VC firm to proceed to more underdeveloped, underserved markets to unearth and polish hidden gems that may, given time and guidance grow into the next Facebook or Uber. Southeast Asia, or more specifically the ASEAN region is one of these regions. Demographics is a key reason this small region might soon be more attractive to invest in than others. With a growing population of 644.1 million, with 70% under the age of 40, a large workforce and consumer base remains to be harnessed (We are Social, 2017). The region is poised to leapfrog even China in terms of tech adoption, with internet users making up 53% of the Southeast Asian population. Southeast Asia is projected to be the fastest growing internet market, rivalled only by India. This is fueling a booming e-commerce sector which has produced at least 2 unicorns, namely the Lazada Group and Tokiopedia, both of which were subject to investments of more than $1 billion by the Alibaba Group.

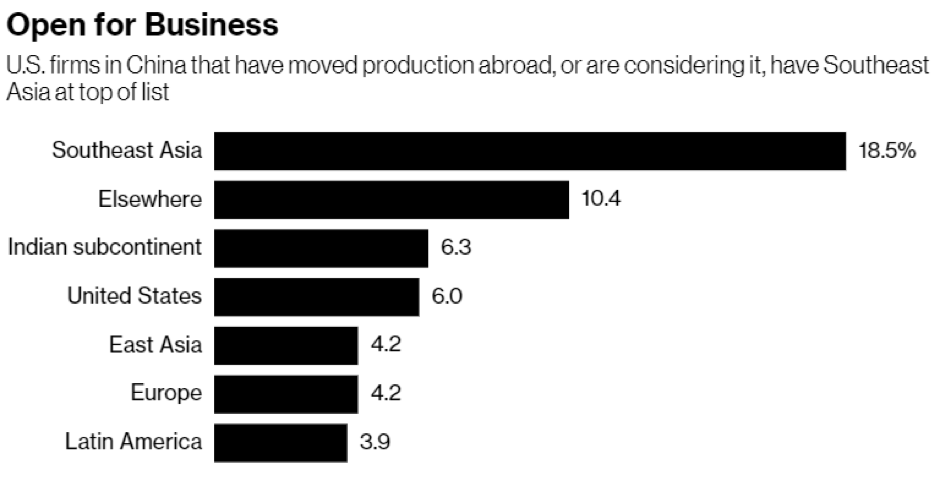

Geography might also contribute to the rise of SEA’s startup scene. Being in proximity to key trade routes and key Asian financial centers, the region is a prime destination for technology giants and internet players. Investors have already poured mouthwatering amounts of cash into the region’s most promising startups across a diverse range of verticals, from logistics to gaming. With the trade war ongoing, some firms have opted to relocate production to Southeast Asia (Bloomberg, 2018), which will boost local economies and stimulate growth. These efforts are yielding fruit, notably in the form of 10 unicorns, with most based in Indonesia, the region’s largest market. This might be a small number compared to its counterparts in larger economies, but the potential for growth is large. VC funds in the region, especially early stage funds are facing increasingly stiff competition. Big players such as Sequoia Capital have made venture investments into the region, facing off against smaller regional funds (TechCrunch, 2018).

The future is bright for Southeast Asia. However, some challenges remain, such as the lack of unified regulations and fragmented markets, with diverse consumer patterns taking hold in different nations. Potential political instability might also spook investors, but with many parts of the world facing similar upheavals it might be a risk investors are willing to take.