Oil Currencies: The Fight for Global Dominance

The Petrodollar system, whereby oil from OPECs are traded only in US Dollars, holds the key to American global dominance. China is trying to change that

The United States of America has had a significant presence in the Middle East, a region so far away from it. Why? The reason is the preservation of the Petrodollar system, the currency in which most oil is traded. The demise of this system would bring about a colossal powershift from West to East: potentially crashing oil prices, currency values, and stock prices, eclipsing the 1930’s Wall Street crash and 2008 Financial Crisis. Not only would it shift the world’s financial epicentre, it would impact basic social values such as freedom of speech and press. What could trigger this crash? The principal adversary of the Petrodollar system is Chinese President Xi Jinping, who is bidding to boost his country’s dominance on the world stage and repealing the economic slowdown that China faces. A change in Washington’s strategy in the Middle East and new investments by Beijing can potentially trigger a powershift in this region and possibly the world.

The Petrodollar system was born in 1973, at a time when oil prices and inflation were rising rapidly in the US due to increasing debt caused partially by the Vietnam war, increased domestic spending and a government deficit. To prevent a potential collapse of the dollar, the Nixon government decided to end the convertibility of the US dollar into gold, thus making the US Dollar the world’s first modern fiduciary currency. In 1974, the American government signed a bilateral agreement with Saudi Arabia stating that all oil would be sold in dollars, and in return, the Kingdom of Saudi Arabia gained US military protection and assistance. Under Saudi influence, other countries in the Organization of Petroleum Exporting Countries (OPEC) also agreed to sell oil in dollars. This was a time when OPEC countries were keen on US protection, due to Soviet intervention in Afghanistan and the fall of the Iranian Shah. Thus, the Petrodollar system came to life.

OPEC countries gain many benefits from trading with the Petrodollar system, such as being able to invest in secure American investments rather than volatile local projects. Even more beneficial for the United States is the extra liquidity and foreign capital given to its financial markets - known as Petrodollar recycling. These recycled dollars keep interest rates low and promotes inflation free growth by effectively allowing the US to borrow its own money. This system has made the US dollar the world’s global reserve currency, with over 2/3 of global currency reserves in dollars and over 40% of global debt being in dollars. This status enables the US to be a global economic hegemony and the world’s only superpower.

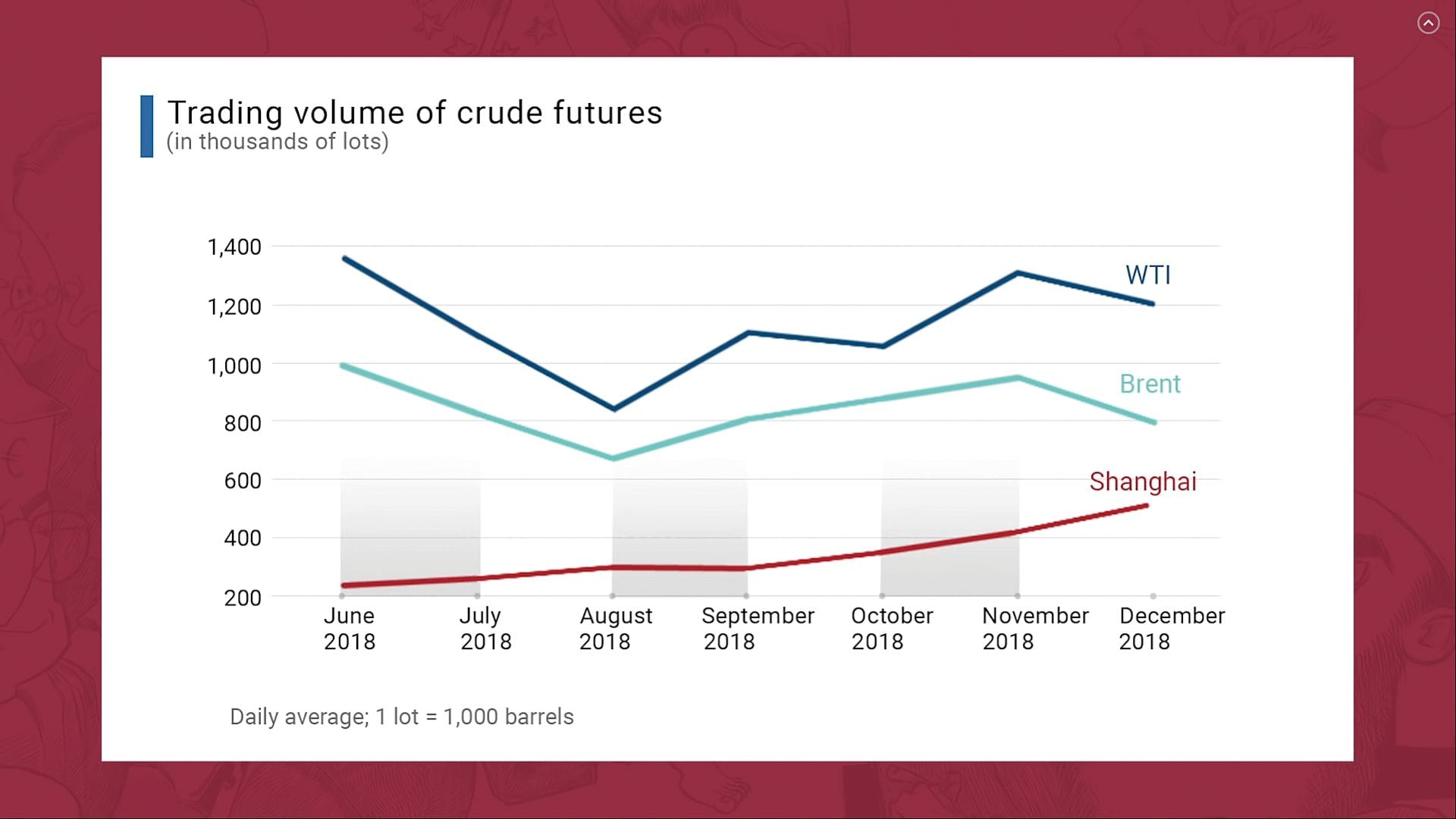

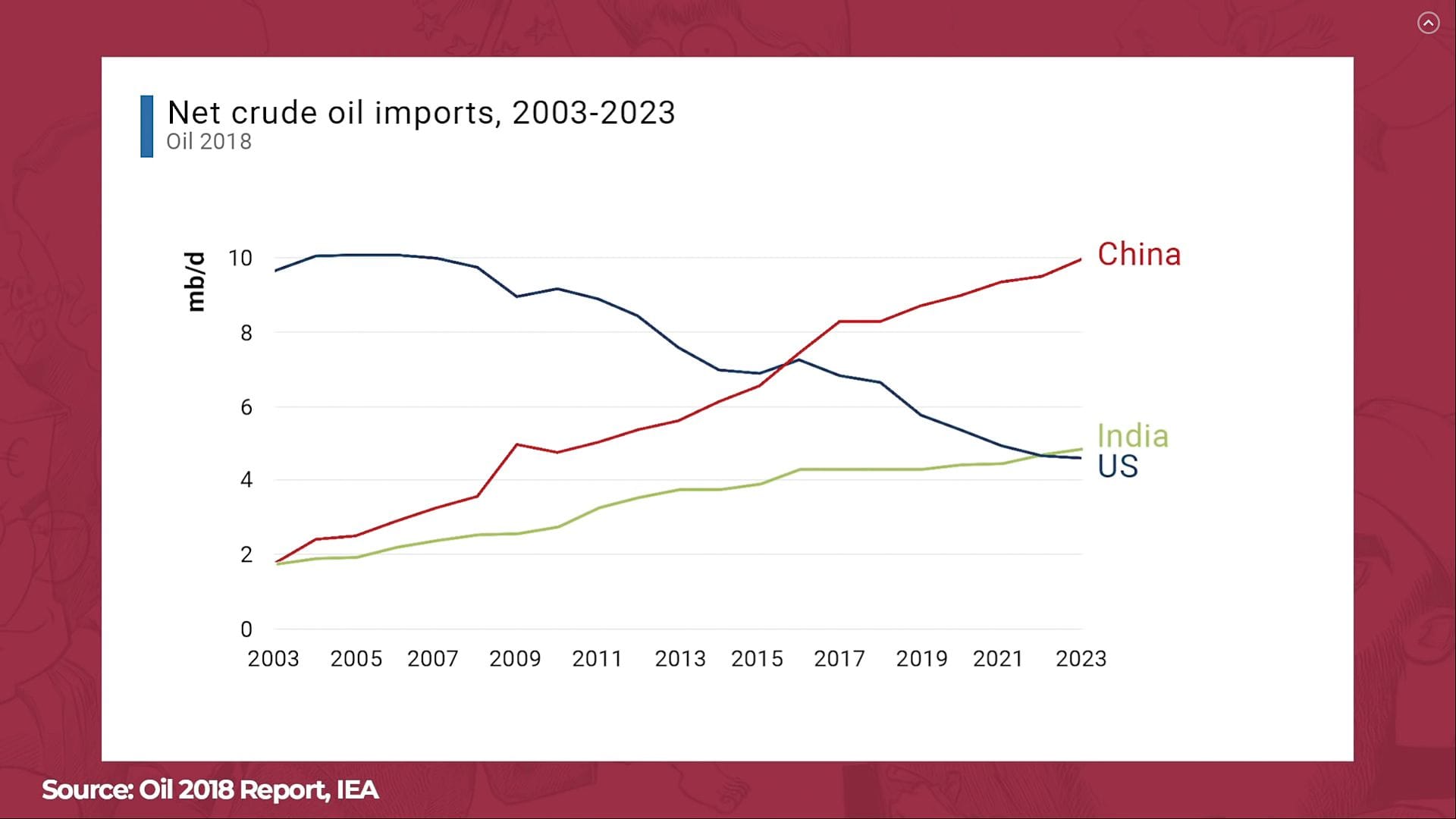

Availability and leverage of natural resources – especially oil – is incredibly important for a nation and can be seen throughout history. A primary example is Nazi Germany, a country that lacked natural oil resources and was forced into producing synthetic oil from coal, a very expensive process. The extensive availability of oil to the Allied Forces and the lack of availability of oil for the Axis Powers arguably resulted in the eventual British and American victory over Nazi Germany in World War 2. For the Peoples Republic of China, the availability and leverage over the oil economy is crucial in its ambitions to become a Global Superpower. Currently China is the world’s biggest coal user (using more coal than the rest of the world combined) and now, the world’s biggest oil importer (see graph). Consequently, this leaves the country in a very vulnerable position – clearly seen as 80% of Chinese debt is denominated in US dollars. Moreover, the US dominance in Middle East puts Chinese trade at risk. China is in a very weak position geopolitically and unless their oil dependence and dollar denominated debt reduces, their economy could shatter if there were a conflict with the United States – if the US were to simply prevent withdrawal of dollars from the US Federal Reserve or use its extensive soft power on allies in the region.

Above: Graphs of trading volume of crude futures, and crude oil imports in China, India, and the US, respectively.

In recent years, Chinese economic growth has slowed, and Chinese foreign investment has sunk worldwide, except in the Middle East. In 2007, the Middle East contributed to only 1% of Chinese foreign investments, but now, China has become the Middle East’s largest investor, with 1 in every 3 euros invested being Chinese. To China, the strategic importance of the Middle East is of utmost importance - it holds 48% of global oil reserves and 40% of global natural gas reserves. The Chinese plan to topple American dominance of Middle East has two main parts.

The first is seen in the investment strategy China commonly uses to create economic interdependence, through schemes such as the Belt and Road Initiative, to give themselves leverage over other nations. Investment is usually in the form of infrastructure, business partnerships and the sale of military technology. In Middle East, the Chinese government-controlled SINOPEC and oil behemoth Saudi ARAMCO has a joint venture to build a $10 billion oil refinery, and a similar refinery is also being built in cooperation with the Government of Kuwait. However, the largest Chinese investment is in Oman. The city of Duqm, only a decade ago it was a small fishing town with a population with 5,100. However, it is expected to grow to 100,000 by 2020 due to increasing foreign investment by China, USA and India. The Chinese will create infrastructure such as highways, buildings and build a port in the area, which will significantly benefit Oman’s economy. However, it is of greater benefit to China as it provides a location which avoids the Strait of Hormuz, which is an increasingly unstable body of water due to Iranian seizures of oil tankers.

Secondly, in addition to creating links with the Middle East, China is attempting to create an oil trading the Petroyuan, to compete with and topple the Petrodollar. Currently the Yuan has very little influence on the world in comparison to the Dollar and the Euro. This is primarily due to the high liquidity of the Yuan and the low trust in the Chinese legal system which scores in the bottom 20 in the world in the WJP Open Government Index, which ranks legal systems of nearly every country in the world (the USA scores in the global top 15 in comparison). Nonetheless, the Chinese government is trying to tempt more countries into using this alternative system by making the Petroyuan a gold backed currency, with options to fully exchange Petroyuan to gold in both the Shanghai and Hong Kong exchanges. Additionally, countries facing US sanctions can avoid them by switching to the Petroyuan. So far, 4 countries have started to use this system; Iran, Russia, Venezuela and Angola, all countries that have been sanctioned for reasons political reasons and human rights abuses. This escape from US sanctions and being a gold backed form of currency are very attractive to many countries. This new system – if successful – would enable China to grow their slowing economy and allow it the same privileges that the US has seen with its Petrodollar system, potentially making China a global superpower.

This new Chinese approach comes at a time where the United States is profoundly altering its Middle Eastern strategy. Both the Obama and Trump administrations have wanted to lessen American dependence on OPEC oil, lower military presence in the region and rather prioritise its focus on the Asia-Pacific region. The United States has reduced the number of troops in nearly all parts of the region – with an exception to Saudi Arabia, who it has pledged to protect.

Moreover, the United States has tried to reduce its dependence on foreign oil. In 2007, it imported 12 billion barrels of oil per day, whereas in 2017 it imported 2 billion barrels of foreign oil per day. Recently it became a net oil exporter, competing with the Middle Eastern oil giants.

The US increasingly views the Middle East as a strategic defence location, and China is attempting to fill in America’s position as the dominant power in the Middle East for 2 reasons; to secure its oil sources and for strategic purposes for shipping. The port of Duqm is also currently receiving US and Indian investment. Moreover, having a port in Duqm and a trade route into the Middle East can potentially reduce Chinese dependence on shipping in the Indian Ocean, in which China’s access can be blocked by the USA and India, the two main naval powers in the Indian Ocean. Increased influence in the global oil trade would empower Beijing and give it leverage over rivals such as India – a country which is currently seeing faster economic growth than China – who also depend on oil imports.

In conclusion, if more countries switch to the Petroyuan system, the influence and global dominance of the United States of America will greatly decrease while Chinese soft power would grow. This would impact everyone in the world in nearly all aspects of life; from international laws and regulation, to leverage on freedom of speech and media freedoms. The endgame on who becomes the dominant power of the 21st century may be dependent on decisions by OPEC on whether to cease or continue trading oil in dollars. For better or worse, the world as we know it will change.