From Lockdown to Heads Down: Time to Repent for Fiscal Extravagances

The UK has largely weathered the storm of the medical crisis and must now turn its attention to reintroducing a sustainable economic condition

The state of lockdown has halted production across the country and created an impenetrable barrier to growth. The country holds its breath in the wake of the most severe national emergency since the Second World War. As of May 17th, 35,000 people have lost their lives, with countless more saved by the government’s ‘stay at home’ order. In doing so, the government has shifted the country from a medical to an economic crisis. The current situation must consequently not extend beyond absolutely necessary.

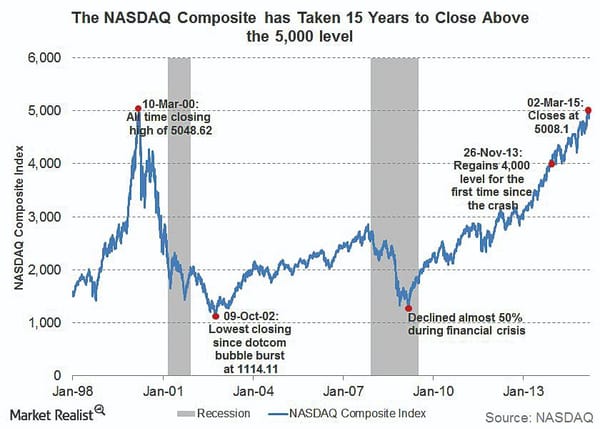

In the first quarter, the Office of National Statistics (ONS) has reported a 2.0% fall in GDP and its latest data suggests a fall of around 25% for the second quarter. Statista, a business data platform, worries that this could extend to 35%. The government has introduced measures to mediate the consequence of this for individual households and firms: furloughed workers will continue to receive 80% of their wages until July and both large and small businesses are enjoying bailouts. Transport for London and EasyJet are among the benefactors, receiving bailouts of £1.6bn and £600mil respectively. These measures are intended to maintain the structure of the economy in the short term at the cost of an unprecedented fiscal imbalance.

The preservation of the economy is coming at a great cost. On March 17th, Chancellor Rishi Sunak announced £330bn in government aid. Sunak added that ‘If demand is greater than the initial £330bn’ he will ‘go further and provide as much capacity as required’. The extension of the Coronavirus Job Retention Scheme to October is a testament to his honesty. Similarly, it is increasingly likely that the cost of loans and grants provided to businesses will exceed initial estimates. The Office for Budget Responsibility (OBR) believes this will force annual public sector borrowing up to £273bn, the largest deficit since 1945. Today’s problems are being bequeathed to tomorrow’s taxpayers, who will bear the burden of this debt. The ONS calculated national debt at 84.1% of GDP in 2019 but in the wake of Covid-19, the OBR expects it to top 100%. The opportunity cost will become apparent in future austerity programmes and lower national incomes.

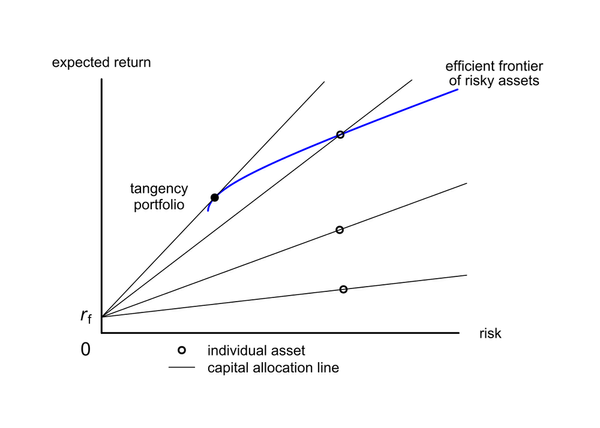

This is not intrinsically objectionable. Few would contend that in such a momentous time the government ought not take equally momentous decisions. It is the government’s responsibility to provide those whose work is obstructed by the lockdown with support. The nationwide cabin fever and frustration imply a political decision too, where preserving household incomes becomes integral to an effective medical response and inspiring public morale. Moreover, the rationale behind the fiscal spree is to preserve the framework of the economy. In the absence of any significant structural damage, there is a near-unanimous consensus among economists that the UK will experience a swift recovery to pre-crisis growth levels. The National Institute for Economic Review (NIER) believes that by the fourth quarter, GDP will have fallen by just 7% year-on-year. Following this, it projects a rise of 7% in 2021 to above pre-crisis levels.

This scenario is optimistic and subject to a number of key variables. Foremost among these is the level of consumer demand. The government’s policies are rightfully focused on preserving the supply side of the economy but in the absence of adequate post-crisis demand they will become futile. Modelling assumes minimal structural damage and depends on how the lockdown is lifted, which is very hard to predict. Predictions of rapid post-crisis growth justify the government’s newly accumulated debts and its implications, but rest on the assumption that the economy returns rapidly to pre-crisis levels.

A perpetuation of the lockdown would inhibit this. The level of structural damage would exponentially increase with firms forcibly prohibited from operating. More firms would go under despite government loans, thereby reducing productive capacity and the scope for post-lockdown recovery. Here the political debate surrounding individual liberty becomes relevant - for how much longer can the government reasonably override the nation’s right to work? The government’s ability to sustain its fiscal stimulus would dwindle and growing private sector debts limit future growth and business investment. These considerations are paramount to reintroducing a normal economic state of affairs in the UK.

Meanwhile the NHS is stretched to financial breaking point. Before the onset of the virus, 83% of Intensive Care Unit beds were occupied and the supply of ventilators early exceeded 8,000. Field hospitals have been constructed, like the Nightingale Hospital at the Excel Centre, and colossal volumes of equipment have been ordered. Time will be the true test of the NHS’ response and likewise will the cost of these measures become clearer going forward. By the end of the crisis, the NHS will have racked up a formidable bill far above the £5bn entailed in the Chancellor’s budget earlier this year.

As it stands, NIER estimates £11,000 foregone per head over the next decade. This rises every day. There is a fast-approaching point at which this cost outweighs the humanitarian benefit of containing the virus. The country must inevitably superimpose the economic consequences of Covid-19 and address the normative question of where saving dependents’ lives becomes no longer justifiable. Failing this, the creation of long-term structural issues and the expansion of national debt will ensure a downward economic trajectory over coming decades.