Navigating the Sustainable Investment Landscape

This investment article takes on a holistic look at sustainable investing landscape with graphs and statistics, particularly touching on what are the drivers and how is the current state of sustainable investing.

Major companies in the world are now facing increasing pressure to act more sustainably and to disclose various sustainability metrics as sustainability becomes a key factor.

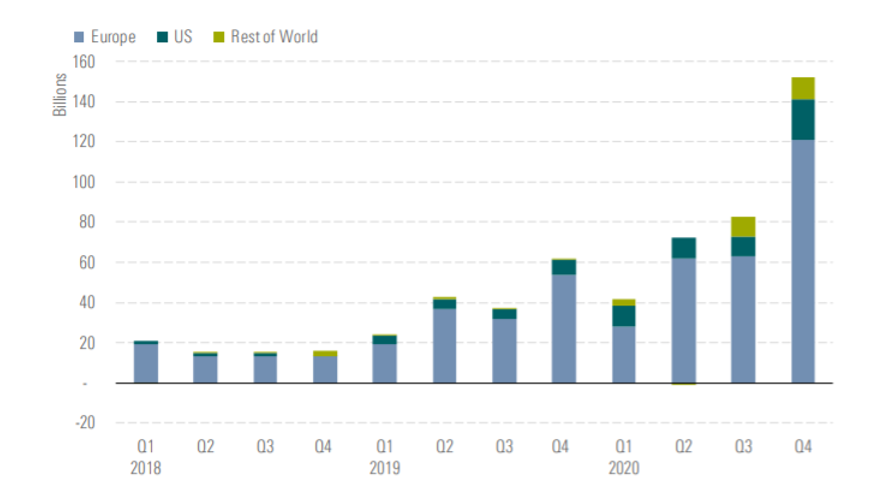

In recent years, sustainable investing has been among the hottest topics on Wall Street and main street, demonstrating its rising importance in the financial market. According to Morningstar, the global inflows into sustainable funds were up 88% in the fourth quarter of 2020 to USD 152.3 billion, hitting a record high of USD 1.65 trillion in terms of assets as of the end of December 2020. The swell in sustainable fund flows has marked the beginning of a long but rapidly accelerating transition and capital reallocation that would fundamentally transform asset prices of every type. So, what does sustainable investing really mean? What drives its growth? And, how are the sustainable portfolios currently performing?

What is sustainable investing?

Sustainable investing has always been referred to as ESG investing with both terms being used interchangeably. However, sustainable investing is a blanket term to invest in any company’s effort in taking responsible and sustainable approaches while pursuing financial goals, whereas ESG investing only focuses on the three key pillars of sustainability factors – Environment, Social and Governance. (Further elaboration about ESG can be explored in another article written by Aishwarya Varanasi) Thus, it is crucial to understand how sustainable investing could be properly defined.

Sustainable investing can be generally categorised into reactive and proactive strategies. Reactive strategy mainly involves the elimination of certain companies or sectors that are associated with increased ESG risks or that violates the asset owner’s values. Within such strategy, negative screening is the dominant investment approach which aims to exclude companies or sectors with objectionable activities, such as the possession of controversial weapons and the involvement in thermal coal or tobacco, from the investment portfolio. For instance, the MSCI constructs the MSCI Global ex Controversial Weapons indexes for standard size-segment in all MSCI Developed and Emerging Markets to exclude companies involved in controversial weapons. Besides, broad ESG screening is another reactive approach which invests in securities based on overall ESG performance and the best-in-class methodology. With the best-in-class methodology, companies from each sector that earns the highest ESG scores will be chosen. Currently, the reactive strategies are more commonly integrated into investment portfolios especially for passively managed funds as best-in-class approach usually aligns well to passive investment portfolios. For example, the MSCI Socially Responsible Investing (SRI) Indexes employed the ‘best-in-class’ selection approach to target the top 25% companies in each sector according to their respective MSCI ESG Ratings.

On the other hand, proactive strategies often aim to achieve more specific sustainable goals with more ambitious targets. Proactive strategies can be either a thematic ESG or impact investing approach. Thematic ESG approach aims to pursue a specific environmental, social or governance goal that capitalises on certain long-term transformative industry trends such as energy transition and workforce diversity. For instance, the MSCI Climate Change indexes are designed to represent the performance of an investment strategy that re-weights securities based on opportunities and risks associated with the transition to a lower carbon economy. Meanwhile, impact investing is designed with the intention to contribute measurable environmental, social, or sustainable development goals (SDG) outcomes alongside financial returns. Other than financial results, established impact metrics such as the reduction of carbon dioxide emission will also be reported as part of the investment outcomes. This approach can be now related to specific green bond, renewable power mandates and global equity impact portfolios, such as the BlackRock Global Impact Fund.

What drives sustainable investing?

There are three key driving factors for sustainable investing. Firstly, investors now have a stronger awareness of sustainability issues driven by the COVID-19 pandemic and climate change issues and have begun to seek more sustainable investment solutions. For instance, the shares of the world’s largest rubber glove maker, Top Glove, fell sharply with raising concerns over a COVID-19 outbreak within its worker dormitories which consequently took an employee’s life. Despite the spike in glove demand, Top Glove’s inadequate management of its workers’ living conditions and wellbeing, as well as its decision to fire a whistle-blower have been heavily scrutinised with potential legal actions.

According to a survey by the world’s largest asset manager, BlackRock, about 54% of global respondents will consider sustainable investing to be fundamental to investment processes and outcomes, with 86% of EMEA respondents stating that sustainable investing is already or will become central to their investment strategies. Thus, major companies in the world are now facing increasing pressure to act more sustainably and to disclose various sustainability metrics as sustainability becomes a key factor for investment consideration.

Besides, increasing government influence and commitment to expanding sustainability-focused initiatives also creates more sustainable investment opportunities in areas such as renewable energy and electric cars production. Ahead of the United Nations Climate Change Conference 2021 (COP26) expected to take place in Glasgow, the UK government laid out a long-awaited 10-point plan for a ‘green industrial revolution’ to put the UK on a path in achieving carbon neutrality by 2050. Meanwhile, the European Union, Japan, and the United States have also announced their net-zero target by 2050, while the world largest emitter, China, is aiming to achieve carbon neutrality by 2060. Amid the pandemic, there have also been ideas to ‘build back better and greener’ in the UK and US, with the EU proposing the Green Deal within its recovery plans which set aside 25% of EU spending on climate-friendly expenditure. Such initiatives will thus direct private and public investments into technology to support relevant social or environmental objectives. Financial products are also likely to be imposed with more binding rules to ensure that they are aligned with sustainability goals set by the governments.

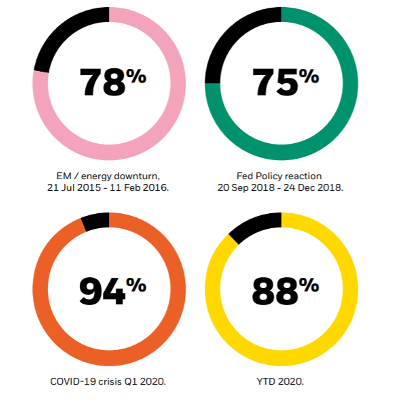

Lastly, sustainable investments will no longer have to be treated as a trade-off to return potential as they have proven to be resilient with the potential to generate excess return. This is mainly due to its nature of having lesser exposure towards various investment risks such as legal and climate risks while having more exposure towards some fastest-growing industries that align with sustainability trends. Generally, there has been better risk-adjusted performance across sustainable products globally. In the first quarter of 2020, Morningstar reported that 51 out of 57 of their sustainable indices outperformed their broad market counterparts, while MSCI reported that 15 of their 17 sustainable indices outperforming broad market counterparts as well. Besides, BlackRock’s research has shown that sustainable indices especially outperformed their parent benchmarks during downturns such as COVID-19 crisis. Additionally, the same research has also demonstrated that the top 10% open-ended funds on Morningstar’s sustainability ratings have significantly outperformed the bottom 10% of the funds too. These positive historical performances have thus given investors more confidence to invest in sustainable funds without sacrificing financial incentives.

Current State of Sustainable Investing

Over recent years, major investment banks and asset managers have been actively pushing for the integration of sustainability factors into their portfolios. A 2018 Morgan Stanley survey found that 84% of asset owners are pursuing or actively considering integrating ESG into their investment process, and 60% of them have already begun doing so in the past. Some of the largest asset managers such as BlackRock and BNP Paribas asset management have announced to divest from thermal coal production, while some largest pension funds based in Norway and Japan took a different approach to actively engage with coal and oil companies in combating climate change.

However, there has been concern about greenwashing – a term used to describe the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound. Some asset managers are accused of rebranding existing funds with green credentials to leverage on the sustainability trends, therefore attracting flows to some struggling funds. Some ESG funds are also criticised for not being ‘green’ enough. Today, three of the largest 12 ESG funds with combined assets under management of USD 85bn still have exposure to oil & gas groups such as ExxonMobil and Chevon.

Hence, a more coherent and comprehensive sustainability standard needs to be determined across the industry to increase the effectiveness and transparency of sustainable funds. Recently, companies have been urged to report their sustainability metrics according to independent establishments such as the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). Those standardised disclosures could allow companies, asset managers and the investors to understand better of the financial implications associated with various sustainability factors, therefore channelling investments to more sustainable and resilient businesses.

Some last words…

In short, sustainable investing is a work in progress that is gaining increasing attention and momentum. It has the potential to reshape the investment landscape and recreate more transparent and accountable capitalism. While its effectiveness in generating strong financial return while doing good remains debatable to some extents, sustainable investing will nevertheless stay as a trend we can’t afford to ignore.