The last market maker? Why AGI may be the end of trading as we know it

From AlphaGo to AlphaFold, AGI’s next frontier could be reshaping financial markets.

When IBM’s Deep Blue beat Garry Kasparov in 1997, it was a big moment. It showed a machine could out-calculate a human. But Deep Blue was built for only one thing – to play chess. It was a specialist, not a thinker.

The 2010s set a new milestone: systems that learn across tasks. In 2016, AlphaGo used neural networks and tree search to beat Lee Sedol at Go. a game seen as too complex for brute force, marking a genuine leap in machine learning-driven intuition. AlphaGo’s machines could learn patterns and make creative choices.

A year later, AlphaZero taught itself chess, shogi and Go. It started from nothing. It played itself, learning from wins and losses – no human openings, no coaching, just reinforcement learning. That was a step toward systems that can generalise. Eventually, this intelligence system went beyond games when AlphaFold predicted protein shapes with striking accuracy in 2021, speeding up biology and drug discovery for years to come.

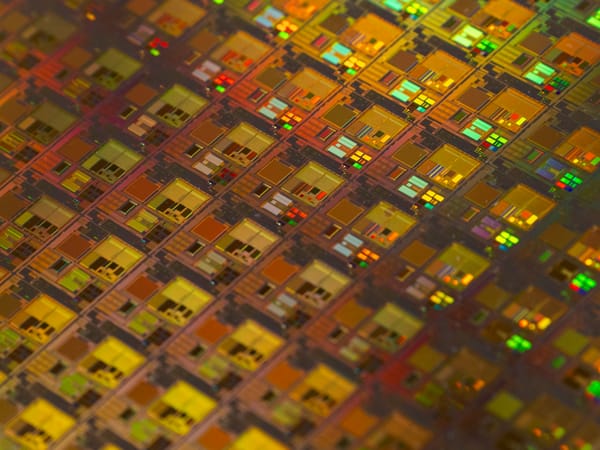

So, what does this path mean for finance? Today, we use Narrow AI: algorithms that optimise specific tasks like execution, sentiment parsing, fraud detection and compliance in bounded settings. Artificial General Intelligence (AGI) implementation would point to something broader: agents that generalise across domains, read macro signals, interpret geopolitical shocks, scan order books and merge on-chain and offchain data into unified strategies.

Two futures can help us picture the change. First, AGI as the ultimate market maker. Here, superfast agents set prices across many venues at once. They digest news and flow in a flash, anticipate liquidity before it appears, and discover new strategies beyond human intuition (like AlphaGo).

Firms that master multi-modal AGI tooling can see the market in ‘full spectrum’ rather than through narrow lenses.

As a result, spreads tighten, arbitrage dries up, and human day trading loses edge. However, if spreads vanished, banks would have to pivot their business model. They would have to license and charge for AGI-powered platforms and other services like high-quality data, insight, risk and hedging. Execution would become a commodity as value shifted to advice, design and science-grade analytics.

Second, the “distributed intelligence” vision. Rather than a single omniscient system, a constellation of cooperating AGI agents could form self-organising financial networks: portfolio optimisers exchanging signals with risk engines, liquidity bots coordinating across venues, and credit models adapting jointly to new data. That “swarm” concept emphasises resilience and adaptability over centralisation and points to a finance stack where autonomous agents collaborate, not just compete.

To me, the near-term implications feel tangible in three areas, even before AGI arrives. First, strategy discovery beyond human priors. AlphaGo once played a move almost no human would try. Finance may see the same thing. Systems can link satellite images of supply chains with funding costs and inventory data, then build a trade from idea to exit. As a result, quiet edges could appear where no one looked before.

Second, unified multi-modal tooling. The same architectures that judged Go positions can blend text from earnings calls, numbers from time series, images from satellites, and graphs from blockchain networks all into one loop. Firms that master multi-modal AGI tooling will dominate idea-to-execution pipelines, because they can see the market in “full spectrum” rather than through narrow lenses.

Finally, science-grade finance. AlphaFold showed how general learners can crack longstanding problems. Finance has its equivalents: systemic risk now casting, counterparty graph inference and stress propagation modelling that benefit from agentic AI.

The opportunity is large, but so is the responsibility.

However, the business reality of it matters too. Breakthroughs like AlphaGo/AlphaZero were science-first, not quarterly-first. This means that the firms that fund long horizon research into agentic systems, rather than simply bolting AI onto legacy pipelines, will own the next wave of risk management, portfolio construction, and compliance automation.

As AI capabilities scale, the financial system will need governance frameworks emphasising transparency, accountability, safety and human oversight – principles already articulated by central bank researchers. The goal isn’t to slow innovation but to keep markets safe as autonomous agents become more capable. As Narrow tools become general agents, some will act like ultra-efficient market makers, while others will form swarms that cooperate. The opportunity is large, but so is the responsibility