This Week In Business 7/11/2025

Big tech earnings outshine Trump-Xi summit

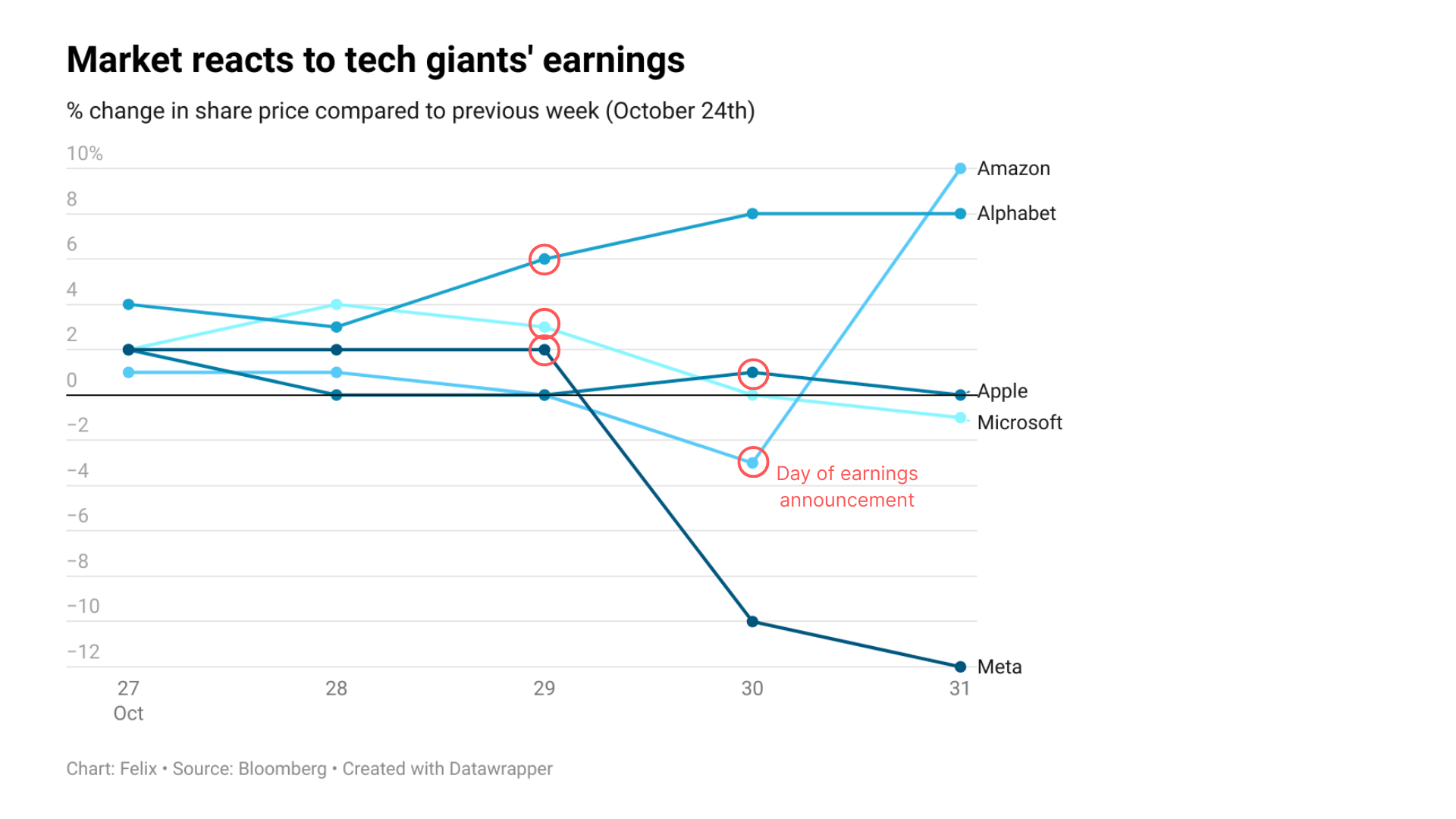

US President Donald Trump was keen to hype up the results of his meeting with Chinese President Xi Jinping on October 30th – he rated it a “12 out of 10.” However, commentators argued that temporary agreements made between the leaders represent “a pause rather than a conclusion” in escalated trade tensions. Investors had high hopes for the meeting – the S&P 500 gained 1.2% in the days leading up to it – but Trump’s spotlight was swiftly stolen by earnings announcements five of Big Tech’s “Magnificent Seven.”

Chatter about the ominous form of a suspected “AI bubble” meant investors paid special attention to earnings reported by Microsoft, Alphabet, Meta, Amazon, and Apple on October 29th and 30th. Whilst all companies reported huge increases in AI-related investment, investors made it clear that they want to see proof that balance sheets can withstand this pressure. Meta’s shares fell 11% on Thursday, as it was revealed that its free cash flow numbers were struggling to keep up with its AI spending spree – the company is the only one out of the five that expects to see free cash flow fall in 2026. Meanwhile, Amazon’s stock jumped 10% following the impressive growth figures it posted for its cloud business, AWS.