Venture Capital vs. Private Equity

Investment writer Subleen Kaur explains the differences between venture capital and private equity companies and how their investment strategies differ

It’s usually not uncommon to find people overlapping terms that have slim differences. Venture Capital and Private Equity have been residing in the book of confusion for many. At first glance, they seem the same: the lending of money to start-ups and privately held companies in the hope that they would yield 30 times the return. The devil (and the difference) lies in the details! Let’s first examine each individually.

Venture capital companies support the growing firms in their early stage before they make an offer publicly. The financier is called Venture Capitalist, and the capital is given as equity capital. The VC funding is related to huge initial capital investment business or sunrise segments such as information technology. The return factor and risk in such a type of funding are comparatively higher.

Notable difference between private equity and venture capital:

Venture capitalists bet on high- growth-potential-exhibiting companies, mainly startups that are likely to disrupt the industry. This kind of investing involves injecting funds or cash into a business in exchange for minority stakes. Private equity, on the other hand, will typically invest in a mature company, one which has been in operation for many years. The company might be failing to produce profits due to various reasons or general inefficiency. A PE firm then buys it and streamlines its operations for improving revenues.

Private equity firms aim at occupying a major chunk. They usually buy 50% of the companies in which they are investing and therefore, are in total control of the firm after the buyout. Venture capital companies invest in 49% or less of the equity of the

firms. Most VC firms prefer to distribute their risk and invest in many diverse companies. Hence, even if one startup fails, the entire finance in the venture capital firm is not substantially affected.

Some other distinguishing points:

Industries - PE investments are more diversified across industries, irrespective of the business type. Venture capital, on the other hand, is more carried out in industries requiring heavy initial investments such as high technology, energy conservation, and so on. They are more leaning towards disruptive technologies.

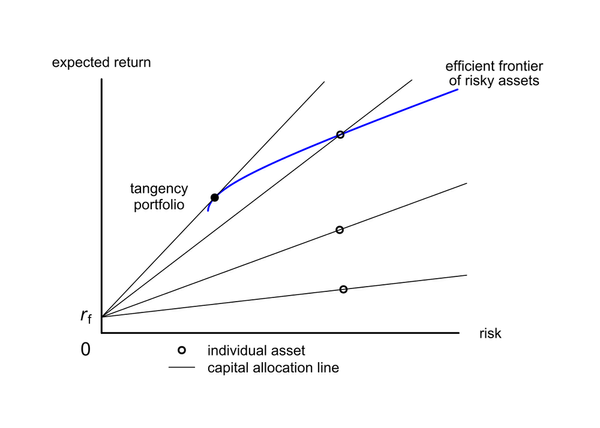

Risk appetite - Venture capitalists invest in funding start-ups where there is no guarantee that the company or companies they are investing in will give yield significantly higher returns. Therefore, they already believe that most of the companies that they invest in will fail. At the same time, there is hope, that at least one of them will be successful, generate huge funds and make the entire investment profitable. On the contrary, such an approach would not be applied by private equity. This is because the investment size is very large for PE, but the number of investments are small in number. Therefore, even if a single firm fails, the entire fund will be condemned. That is why PE funds are invested in developed and matured companies where there is almost a 0% chance of failure in the future.

Entrepreneurs take more VC benefits

Reward and risk: The life cycles of PEs and VCs depict a difference in the way they look at risks and rewards. PE funds usually operate in a highly structured way. Their basic approach is to make investments in a company, improve it, and later sell it off for a higher price. On the other hand, VCs typically raise a fund and then spend ten years putting that money into various companies, in order to make a return on that investment.

Post-investment attitudes - PEs get highly involved in the overall functioning of the more mature companies that they have acquired. They want to improve them in the hopes of getting a higher selling price in the future. Hence, they aim at making evident developments for increased growth. They are well aware that if the company does not show improvements, the entire approach could be a failure, and hence, they aim to have a large impact and influence the decisions and inner workings of the company. This is possible as they have a majority stake in the firm. Meanwhile, VCs work hands-on with the companies very early, particularly in their development stage. When the term ‘value-add’ is used by VCs, they are referring to helping start- ups with partnerships, hiring, back- office support, and various other vital functions. These value-adds can be crucial to a young company and allow the entrepreneurs to utilise the benefits of the connections and experience of a VC.

While PE and VC firms differ in their approach, the line between them can be hazy, as a company may take investments from both throughout its lifecycle as it grows from an early-stage startup into a mature, late-stage company.