This Week in Business 14/11/2025

Jittery market sells AI stocks

You might be wondering why a photo of Christian Bale is featured in this week’s Felix Business news piece (a proud moment for him, I’m sure). The trader played by Bale in the 2015 film The Big Short, Michael Burry, has been blamed by media outlets for the sell-off in major tech stocks that happened last week. This comes after he announced a $1.1 bn short position on Nvidia and Palantir, citing his worries about a growing AI bubble.

The reality is that Burry is not the only one voicing his concerns. The market has been particularly jumpy in recent times due to concerns about astronomical capital expenditures into AI growth by the tech majors - spending which has not yet been validated by significant returns on investment. The heads of Morgan Stanley and Goldman Sachs warned investors last week that a 10-20% equity market correction is looming, and JPMorgan boss Jamie Dimon said in October that he was “far more worried than others” that markets would crash in the near future.

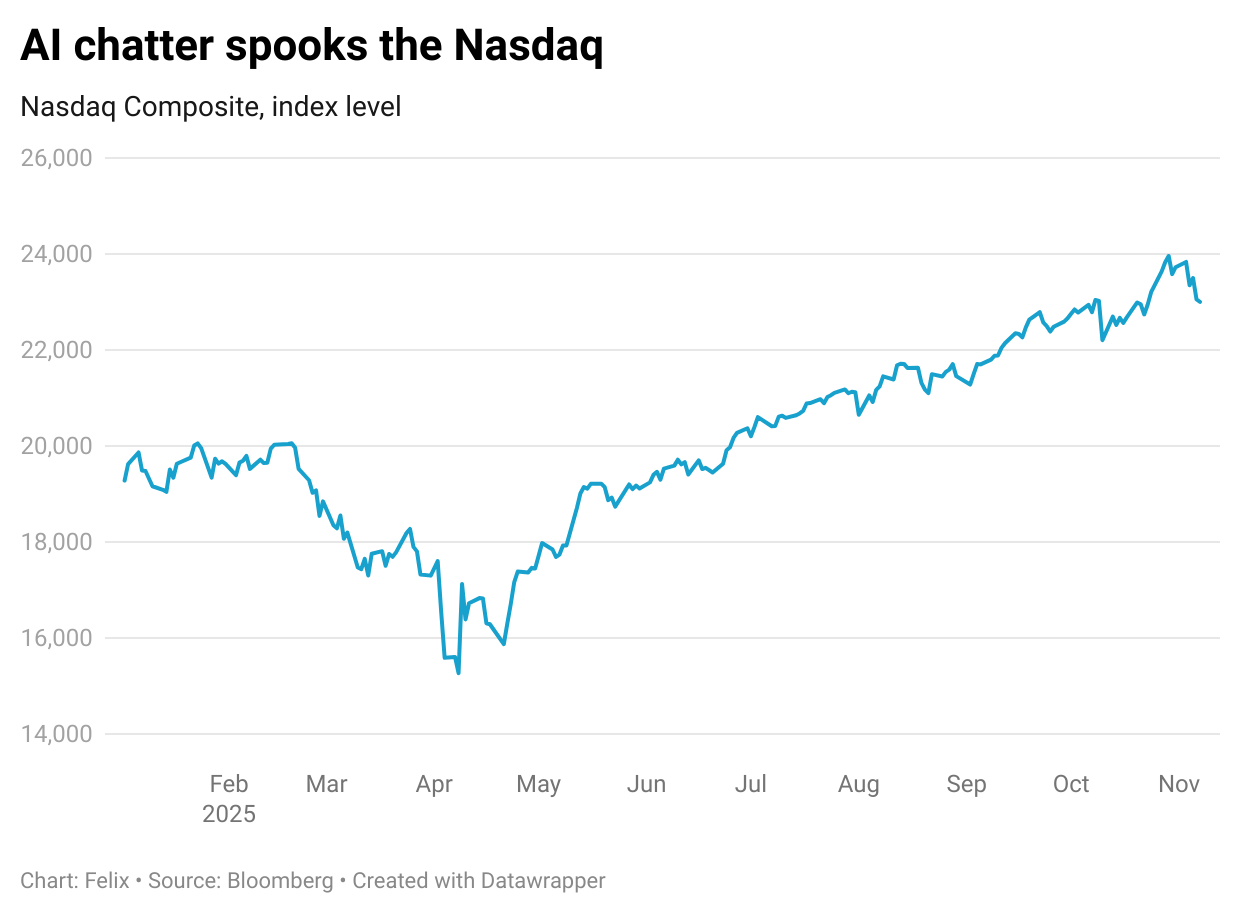

All of this rhetoric has caused investors to have their hand on the panic button, ready for whenever a big AI-related story makes the headlines. On November 7th the Nasdaq Composite, an index that is heavily weighted towards tech stocks, recorded its worst weekly run since Trump’s “Liberation Day” tariff announcements in April. AI major Palantir’s CEO criticised Burry and his fellow short-sellers for “trying to call the AI revolution into question.” However, it looks like AI bosses are going to have to do more to soothe the market’s growing anxiety.